BRUSSELS--(BUSINESS WIRE)--Anheuser-Busch InBev (Brussel:ABI) (BMV:ANB) (JSE:ANH) (NYSE:BUD):

Regulated information1

“The strength of the beer category, our diversified global footprint and the continued momentum of our megabrands delivered another quarter of broad-based top- and bottom-line growth. We are encouraged by our results to start the year, and the consistent execution by our teams and partners reinforces our confidence in delivering on our 2024 growth ambitions.” – Michel Doukeris, CEO, AB InBev

| Total Revenue + 2.6% Revenue increased by 2.6% with revenue per hl growth of 3.3%.

6.7% increase in combined revenues of our megabrands, led by Corona, which grew by 15.5% outside of its home market.

Approximately 70% of our revenue is through B2B digital platforms with the monthly active user base of BEES reaching 3.6 million users.

Approximately 130 million USD of revenue generated by our digital direct-to-consumer ecosystem.

Total Volume - 0.6% Total volumes declined by 0.6%, with own beer volumes down by 1.3% and non-beer volumes up by 3.5%. | Normalized EBITDA + 5.4% Normalized EBITDA increased by 5.4% to 4 987 million USD with a normalized EBITDA margin expansion of 90 bps to 34.3%.

Underlying Profit 1 509 million USD Underlying profit (profit attributable to equity holders of AB InBev excluding non-underlying items and the impact of hyperinflation) was 1 509 million USD in 1Q24 compared to 1 310 million USD in 1Q23.

Underlying EPS 0.75 USD Underlying EPS was 0.75 USD in 1Q24, an increase from 0.65 USD in 1Q23.

|

| 1The enclosed information constitutes regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 12. |

Management comments

Consistent execution of our strategy delivered a 5.4% EBITDA increase with margin expansion, and 16% Underlying EPS growth

Top-line increased by 2.6%, with revenue growth in approximately 75% of our markets, driven by a revenue per hl increase of 3.3% as a result of revenue management initiatives and ongoing premiumization. Volumes declined by 0.6%, as growth in our Middle Americas, South America, Africa and Europe regions was offset by performance in APAC and North America. EBITDA increased by 5.4% with disciplined overhead management enabling increased sales and marketing investments in our brands and EBITDA margin expansion of 90bps. Underlying EPS was 0.75 USD, a 16% increase versus 1Q23, driven primarily by nominal EBITDA growth and the continued optimization of our business.

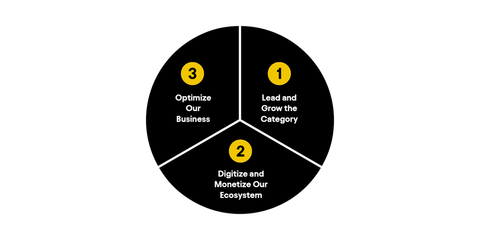

Progressing our strategic priorities

We continue to execute on and invest in three key strategic pillars to deliver consistent growth and long-term value creation.

1. Lead and grow the category:

We delivered volume growth and market share gains in the majority of our markets, according to our estimates.

2. Digitize and monetize our ecosystem:

BEES captured 11.3 billion USD of gross merchandise value (GMV), a 23% increase versus 1Q23 with approximately 70% of our revenue through B2B digital channels. BEES Marketplace is live in 19 markets and captured 465 million USD in GMV from sales of third-party products, a 47% increase versus 1Q23.

3. Optimize our business:

Underlying EPS increased by 16% to reach 0.75 USD, driven by nominal EBITDA growth, margin expansion and optimization of our net finance costs.

1. Lead and grow the category

We are executing on our five proven and scalable levers to drive category expansion. Our performance across each of the levers was led by our megabrands, which represent the majority of our revenue and delivered a 6.7% revenue increase.

2. Digitize and monetize our ecosystem

3. Optimize our business

Creating a future with more cheers

Our business delivered another quarter of profitable growth with an EBITDA increase of 5.4%, margin expansion of 90bps and double-digit Underlying EPS growth. We are investing for the long-term and continue to build on our platform to generate value for our stakeholders. The beer category is large and growing, and our unique global leadership advantages, replicable growth drivers and superior profitability position us well to deliver on our purpose to create a future with more cheers.

2024 Outlook

| Figure 1. Consolidated performance (million USD) | ||||||

| 1Q23 | 1Q24 | Organic | ||||

|

|

| growth | ||||

| Total Volumes (thousand hls) | 140 548 | 139 536 | -0.6% | |||

| AB InBev own beer | 121 060 | 119 387 | -1.3% | |||

| Non-beer volumes | 18 587 | 19 230 | 3.5% | |||

| Third party products | 901 | 919 | 2.0% | |||

| Revenue | 14 213 | 14 547 | 2.6% | |||

| Gross profit | 7 696 | 7 894 | 2.7% | |||

| Gross margin | 54.1% | 54.3% | 3 bps | |||

| Normalized EBITDA | 4 759 | 4 987 | 5.4% | |||

| Normalized EBITDA margin | 33.5% | 34.3% | 90 bps | |||

| Normalized EBIT | 3 503 | 3 642 | 5.0% | |||

| Normalized EBIT margin | 24.6% | 25.0% | 56 bps | |||

|

| ||||||

| Profit attributable to equity holders of AB InBev | 1 639 | 1 091 | ||||

| Underlying profit attributable to equity holders of AB InBev | 1 310 | 1 509 | ||||

|

| ||||||

| Earnings per share (USD) | 0.81 | 0.54 | ||||

| Underlying earnings per share (USD) | 0.65 | 0.75 |

|

| Figure 2. Volumes (thousand hls) | ||||||||||||

| 1Q23 | Scope | Organic | 1Q24 | Organic growth | ||||||||

|

|

| growth |

| Total | Own beer | |||||||

| North America | 23 853 | - 155 | -2 345 | 21 353 | -9.9% | -11.1% | ||||||

| Middle Americas | 34 271 | - 5 | 1 424 | 35 690 | 4.2% | 4.5% | ||||||

| South America | 40 286 | - | 61 | 40 347 | 0.2% | -0.6% | ||||||

| EMEA | 19 958 | - | 1 072 | 21 030 | 5.4% | 4.8% | ||||||

| Asia Pacific | 22 114 | - | -1 069 | 21 045 | -4.8% | -4.7% | ||||||

| Global Export and Holding Companies | 66 | - | 4 | 70 | 5.7% | 7.5% | ||||||

| AB InBev Worldwide | 140 548 | - 160 | - 853 | 139 536 | -0.6% | -1.3% | ||||||

Key Market Performances

United States: Revenue declined by high-single digits impacted by volume performance

Mexico: Mid-single digit top- and bottom-line growth with margin expansion

Colombia: Record high volumes delivered double-digit top-line and high-single digit bottom-line growth

Brazil: Record high volumes delivered mid-single digit top-line and double-digit bottom-line growth with margin expansion of 311bps

Europe: High-single digit top-line and strong double-digit bottom-line growth with margin recovery

South Africa: Record high volumes delivered double digit top- and bottom-line growth with margin expansion

China: Continued premiumization with margin expansion despite soft industry

Highlights from our other markets

Consolidated Income Statement

| Figure 3. Consolidated income statement (million USD) | ||||||

| 1Q23 | 1Q24 | Organic | ||||

| growth | ||||||

| Revenue | 14 213 | 14 547 | 2.6% | |||

| Cost of sales | -6 517 | -6 653 | -2.5% | |||

| Gross profit | 7 696 | 7 894 | 2.7% | |||

| SG&A | -4 344 | -4 435 | -1.4% | |||

| Other operating income/(expenses) | 152 | 183 | 18.3% | |||

| Normalized profit from operations (normalized EBIT) | 3 503 | 3 642 | 5.0% | |||

| Non-underlying items above EBIT (incl. impairment losses) | -46 | -29 |

| |||

| Net finance income/(cost) | -1 237 | -1 187 |

| |||

| Non-underlying net finance income/(cost) | 375 | - 309 |

| |||

| Share of results of associates | 50 | 57 |

| |||

| Non-underlying share of results of associates | - | 104 |

| |||

| Income tax expense | -597 | -794 |

| |||

| Profit | 2 048 | 1 485 |

| |||

| Profit attributable to non-controlling interest | 409 | 393 |

| |||

| Profit attributable to equity holders of AB InBev | 1 639 | 1 091 |

| |||

|

|

| |||||

| Normalized EBITDA | 4 759 | 4 987 | 5.4% | |||

| Underlying profit attributable to equity holders of AB InBev | 1 310 | 1 509 |

|

Consolidated other operating income/(expenses) in 1Q24 increased by 18.3% primarily driven by higher government grants and the impact of disposal of non-core assets.

Non-underlying items above EBIT & Non-underlying share of results of associates

| Figure 4. Non-underlying items above EBIT & Non-underlying share of results of associates (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Restructuring | -27 | -31 | ||

| Business and asset disposal (incl. impairment losses) | -19 | 2 | ||

| Non-underlying items in EBIT | -46 | -29 | ||

| Non-underlying share of results of associates | - | 104 | ||

Non-underlying share of results from associates of 1Q24 includes the impact from our associate Anadolu Efes’ adoption of IAS 29 hyperinflation accounting on their 2023 results.

Net finance income/(cost)

| Figure 5. Net finance income/(cost) (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Net interest expense | -806 | -714 | ||

| Net interest on net defined benefit liabilities | -21 | -22 | ||

| Accretion expense | -183 | -191 | ||

| Net interest income on Brazilian tax credits | 31 | 36 | ||

| Other financial results | -257 | -296 | ||

| Net finance income/(cost) | -1 237 | -1 187 |

Non-underlying net finance income/(cost)

| Figure 6. Non-underlying net finance income/(cost) (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Mark-to-market | 375 | -243 | ||

| Gain/(loss) on bond redemption and other | - | -66 | ||

| Non-underlying net finance income/(cost) | 375 | -309 |

Non-underlying net finance cost in 1Q24 includes mark-to-market losses on derivative instruments entered into in order to hedge our share-based payment programs and shares issued in relation to the combination with Grupo Modelo and SAB, and 66 million USD losses from the impairment of financial investments.

The number of shares covered by the hedging of our share-based payment program, the deferred share instrument and the restricted shares are shown in figure 7, together with the opening and closing share prices.

| Figure 7. Non-underlying equity derivative instruments | ||||

| 1Q23 | 1Q24 | |||

| Share price at the start of the period (Euro) | 56.27 | 58.42 | ||

| Share price at the end of the period (Euro) | 61.33 | 56.46 | ||

| Number of equity derivative instruments at the end of the period (millions) | 100.5 | 100.5 |

Income tax expense

| Figure 8. Income tax expense (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Income tax expense | 597 | 794 | ||

| Effective tax rate | 23.0% | 37.5% | ||

| Normalized effective tax rate | 26.8% | 27.0% |

The 1Q24 effective tax rate was negatively impacted by the non-deductible losses from derivatives related to hedging of share-based payment programs and of the shares issued in a transaction related to the combination with Grupo Modelo and SAB, while the 1Q23 effective tax rate was positively impacted by non-taxable gains on these derivatives.

Furthermore, the 1Q24 effective tax rate includes 240 million USD (4.5 billion ZAR) non-underlying tax cost following the resolution in 1Q24 of the South African tax matters previously described in note 29 Contingencies of the 2023 Consolidated Financial Statements.

| Figure 9. Underlying Profit attributable to equity holders of AB InBev (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Profit attributable to equity holders of AB InBev | 1 639 | 1 091 | ||

| Net impact of non-underlying items on profit | - 342 | 363 | ||

| Hyperinflation impacts in underlying profit | 13 | 55 | ||

| Underlying profit attributable to equity holders of AB InBev | 1 310 | 1 509 | ||

Basic and underlying EPS

| Figure 10. Earnings per share (USD) | ||||

| 1Q23 | 1Q24 | |||

| Basic EPS | 0.81 | 0.54 | ||

| Net impact of non-underlying items on profit | -0.18 | 0.18 | ||

| Hyperinflation impacts in EPS | 0.01 | 0.03 | ||

| Underlying EPS | 0.65 | 0.75 | ||

| Weighted average number of ordinary and restricted shares (million) | 2 015 | 2 007 |

| Figure 11. Key components - Underlying EPS in USD | ||||

| 1Q23 | 1Q24 | |||

| Normalized EBIT before hyperinflation | 1.76 | 1.83 | ||

| Hyperinflation impacts in normalized EBIT | -0.02 | -0.01 | ||

| Normalized EBIT | 1.74 | 1.81 | ||

| Net finance cost | -0.61 | -0.59 | ||

| Income tax expense | -0.30 | -0.33 | ||

| Associates & non-controlling interest | -0.18 | -0.17 | ||

| Hyperinflation impacts in EPS | 0.01 | 0.03 | ||

| Underlying EPS | 0.65 | 0.75 | ||

| Weighted average number of ordinary and restricted shares (million) | 2 015 | 2 007 |

Reconciliation between normalized EBITDA and profit attributable to equity holders

| Figure 12. Reconciliation of normalized EBITDA to profit attributable to equity holders of AB InBev (million USD) | ||||

| 1Q23 | 1Q24 | |||

| Profit attributable to equity holders of AB InBev | 1 639 | 1 091 | ||

| Non-controlling interests | 409 | 393 | ||

| Profit | 2 048 | 1 485 | ||

| Income tax expense | 597 | 794 | ||

| Share of result of associates | -50 | -57 | ||

| Non-underlying share of results of associates | - | -104 | ||

| Net finance (income)/cost | 1 237 | 1 187 | ||

| Non-underlying net finance (income)/cost | -375 | 309 | ||

| Non-underlying items above EBIT (incl. impairment losses) | 46 | 29 | ||

| Normalized EBIT | 3 503 | 3 642 | ||

| Depreciation, amortization and impairment | 1 255 | 1 344 | ||

| Normalized EBITDA | 4 759 | 4 987 | ||

Normalized EBITDA and normalized EBIT are measures utilized by AB InBev to demonstrate the company’s underlying performance.

Normalized EBITDA is calculated excluding the following effects from profit attributable to equity holders of AB InBev: (i) non-controlling interest; (ii) income tax expense; (iii) share of results of associates; (iv) non-underlying share of results of associates; (v) net finance income or cost; (vi) non-underlying net finance income or cost; (vii) non-underlying items above EBIT; and (viii) depreciation, amortization and impairment.

Normalized EBITDA and normalized EBIT are not accounting measures under IFRS accounting and should not be considered as an alternative to profit attributable to equity holders as a measure of operational performance, or an alternative to cash flow as a measure of liquidity. Normalized EBITDA and normalized EBIT do not have a standard calculation method and AB InBev’s definition of normalized EBITDA and normalized EBIT may not be comparable to that of other companies.

Notes

To facilitate the understanding of AB InBev’s underlying performance, the analyses of growth, including all comments in this press release, unless otherwise indicated, are based on organic growth and normalized numbers. In other words, financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scope changes. For FY24, the definition of organic revenue growth has been amended to cap the price growth in Argentina to a maximum of 2% per month (26.8% year-over-year). Corresponding adjustments are made to all income statement related items in the organic growth calculations through scope changes. Scope changes also represent the impact of acquisitions and divestitures, the start or termination of activities or the transfer of activities between segments, curtailment gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of the underlying performance of the business. The organic growth of our global brands, Budweiser, Stella Artois, Corona and Michelob Ultra, excludes exports to Australia for which a perpetual license was granted to a third party upon disposal of the Australia operations in 2020. All references per hectoliter (per hl) exclude US non-beer activities. Whenever presented in this document, all performance measures (EBITDA, EBIT, profit, tax rate, EPS) are presented on a “normalized” basis, which means they are presented before non-underlying items. Non-underlying items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature. Normalized measures are additional measures used by management and should not replace the measures determined in accordance with IFRS as an indicator of the Company’s performance. We are reporting the results from Argentina applying hyperinflation accounting since 3Q18. The IFRS rules (IAS 29) require us to restate the year-to-date results for the change in the general purchasing power of the local currency, using official indices before converting the local amounts at the closing rate of the period. In 1Q24, we reported a negative impact on the profit attributable to equity holders of AB InBev of 55 million USD. The impact in 1Q24 Basic EPS was -0.03 USD. Values in the figures and annexes may not add up, due to rounding. 1Q24 EPS is based upon a weighted average of 2 007 million shares compared to a weighted average of 2 015 million shares for 1Q23.

Legal disclaimer

This release contains “forward-looking statements”. These statements are based on the current expectations and views of future events and developments of the management of AB InBev and are naturally subject to uncertainty and changes in circumstances. The forward-looking statements contained in this release include statements other than historical facts and include statements typically containing words such as “will”, “may”, “should”, “believe”, “intends”, “expects”, “anticipates”, “targets”, “estimates”, “likely”, “foresees” and words of similar import. All statements other than statements of historical facts are forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect the current views of the management of AB InBev, are subject to numerous risks and uncertainties about AB InBev and are dependent on many factors, some of which are outside of AB InBev’s control. There are important factors, risks and uncertainties that could cause actual outcomes and results to be materially different, including, but not limited to the risks and uncertainties relating to AB InBev that are described under Item 3.D of AB InBev’s Annual Report on Form 20-F filed with the SEC on 11 March 2024. Many of these risks and uncertainties are, and will be, exacerbated by any further worsening of the global business and economic environment, including as a result of the ongoing conflict in Russia and Ukraine and in the Middle East, including the conflict in the Red Sea. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements should be read in conjunction with the other cautionary statements that are included elsewhere, including AB InBev’s most recent Form 20-F and other reports furnished on Form 6-K, and any other documents that AB InBev has made public. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements and there can be no assurance that the actual results or developments anticipated by AB InBev will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, AB InBev or its business or operations. Except as required by law, AB InBev undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The first quarter 2024 (1Q24) financial data set out in Figure 1 (except for the volume information), Figures 3 to 5, 6, 8, 9 and 12 of this press release have been extracted from the group’s unaudited condensed consolidated interim financial statements as of and for the three months ended 31 March 2024, which have been reviewed by our statutory auditors PwC Réviseurs d’Entreprises SRL / PwC Bedrijfsrevisoren BV in accordance with the standards of the Public Company Accounting Oversight Board (United States). Financial data included in Figures 7, 10 and 11 have been extracted from the underlying accounting records as of and for the three months ended 31 March 2024 (except for the volume information). References in this document to materials on our websites, such as www.ab-inbev.com, are included as an aid to their location and are not incorporated by reference into this document.

Conference call and webcast

Investor Conference call and webcast on Wednesday, 8 May 2024:

3.00pm Brussels / 2.00pm London / 9.00am New York

Registration details:

Webcast (listen-only mode):

AB InBev 1Q24 Results Webcast

To join by phone, please use one of the following two phone numbers:

Toll-Free: +1-877-407-8029

Toll: +1-201-689-8029

About Anheuser-Busch InBev (AB InBev)

Anheuser-Busch InBev (AB InBev) is a publicly traded company (Euronext: ABI) based in Leuven, Belgium, with secondary listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) stock exchanges and with American Depositary Receipts on the New York Stock Exchange (NYSE: BUD). As a company, we dream big to create a future with more cheers. We are always looking to serve up new ways to meet life’s moments, move our industry forward and make a meaningful impact in the world. We are committed to building great brands that stand the test of time and to brewing the best beers using the finest ingredients. Our diverse portfolio of well over 500 beer brands includes global brands Budweiser®, Corona®, Stella Artois® and Michelob Ultra®; multi-country brands Beck’s®, Hoegaarden® and Leffe®; and local champions such as Aguila®, Antarctica®, Bud Light®, Brahma®, Cass®, Castle®, Castle Lite®, Cristal®, Harbin®, Jupiler®, Modelo Especial®, Quilmes®, Victoria®, Sedrin®, and Skol®. Our brewing heritage dates back more than 600 years, spanning continents and generations. From our European roots at the Den Hoorn brewery in Leuven, Belgium. To the pioneering spirit of the Anheuser & Co brewery in St. Louis, US. To the creation of the Castle Brewery in South Africa during the Johannesburg gold rush. To Bohemia, the first brewery in Brazil. Geographically diversified with a balanced exposure to developed and developing markets, we leverage the collective strengths of approximately 155,000 colleagues based in nearly 50 countries worldwide. For 2023, AB InBev’s reported revenue was 59.4 billion USD (excluding JVs and associates).

Annex 1: Segment reporting

| AB InBev Worldwide | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 140 548 | - 160 | - | - 853 | 139 536 | -0.6% | ||||||

| of which AB InBev own beer | 121 060 | - 150 | - | -1 524 | 119 387 | -1.3% | ||||||

| Revenue | 14 213 | 1 310 | -1 348 | 372 | 14 547 | 2.6% | ||||||

| Cost of sales | -6 517 | - 624 | 655 | - 166 | -6 653 | -2.5% | ||||||

| Gross profit | 7 696 | 686 | - 693 | 207 | 7 894 | 2.7% | ||||||

| SG&A | -4 344 | - 389 | 361 | - 62 | -4 435 | -1.4% | ||||||

| Other operating income/(expenses) | 152 | -2 | 4 | 29 | 183 | 18.3% | ||||||

| Normalized EBIT | 3 503 | 295 | - 329 | 173 | 3 642 | 5.0% | ||||||

| Normalized EBITDA | 4 759 | 391 | - 419 | 255 | 4 987 | 5.4% | ||||||

| Normalized EBITDA margin | 33.5% |

|

|

| 34.3% | 90 bps | ||||||

|

|

|

|

|

|

|

| ||||||

| North America | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 23 853 | - 155 | - | -2 345 | 21 353 | -9.9% | ||||||

| Revenue | 3 973 | - 37 | 2 | - 346 | 3 593 | -8.8% | ||||||

| Cost of sales | -1 675 | 21 | - 1 | 111 | -1 544 | 6.7% | ||||||

| Gross profit | 2 298 | - 16 | 1 | - 234 | 2 049 | -10.3% | ||||||

| SG&A | -1 138 | 17 | - 1 | 37 | -1 085 | 3.3% | ||||||

| Other operating income/(expenses) | 8 | - | - | -20 | -12 | - | ||||||

| Normalized EBIT | 1 168 | 1 | - | - 218 | 951 | -18.6% | ||||||

| Normalized EBITDA | 1 350 | - 1 | 1 | - 224 | 1 126 | -16.6% | ||||||

| Normalized EBITDA margin | 34.0% |

|

|

| 31.3% | -293 bps | ||||||

|

|

|

|

|

|

| |||||||

| Middle Americas | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 34 271 | - 5 | - | 1 424 | 35 690 | 4.2% | ||||||

| Revenue | 3 489 | - 4 | 289 | 278 | 4 051 | 8.0% | ||||||

| Cost of sales | -1 355 | - 7 | - 115 | - 109 | -1 586 | -8.0% | ||||||

| Gross profit | 2 133 | - 11 | 174 | 169 | 2 465 | 8.0% | ||||||

| SG&A | - 878 | 4 | - 71 | - 20 | - 965 | -2.3% | ||||||

| Other operating income/(expenses) | -2 | 7 | 1 | 6 | 12 | - | ||||||

| Normalized EBIT | 1 254 | - | 104 | 155 | 1 512 | 12.3% | ||||||

| Normalized EBITDA | 1 578 | 7 | 133 | 168 | 1 886 | 10.6% | ||||||

| Normalized EBITDA margin | 45.2% |

|

|

| 46.6% | 111 bps | ||||||

|

|

|

|

|

|

|

| ||||||

| South America | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 40 286 | - | - | 61 | 40 347 | 0.2% | ||||||

| Revenue | 3 107 | 1 349 | -1 383 | 159 | 3 233 | 5.1% | ||||||

| Cost of sales | -1 526 | - 630 | 602 | - 32 | -1 586 | -2.1% | ||||||

| Gross profit | 1 581 | 719 | - 780 | 127 | 1 647 | 8.0% | ||||||

| SG&A | - 878 | - 410 | 378 | - 32 | - 941 | -3.5% | ||||||

| Other operating income/(expenses) | 90 | -9 | 14 | 21 | 116 | 23.5% | ||||||

| Normalized EBIT | 793 | 301 | - 388 | 116 | 821 | 14.9% | ||||||

| Normalized EBITDA | 1 029 | 392 | - 480 | 144 | 1 084 | 14.2% | ||||||

| Normalized EBITDA margin | 33.1% |

|

|

| 33.5% | 281 bps |

| EMEA | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 19 958 | - | - | 1 072 | 21 030 | 5.4% | ||||||

| Revenue | 1 823 | 2 | - 195 | 298 | 1 927 | 16.3% | ||||||

| Cost of sales | -1 004 | - 1 | 127 | - 158 | -1 036 | -15.7% | ||||||

| Gross profit | 819 | - | - 67 | 140 | 892 | 17.0% | ||||||

| SG&A | - 645 | - 1 | 36 | - 4 | - 614 | -0.6% | ||||||

| Other operating income/(expenses) | 35 | - | -3 | 11 | 44 | 32.4% | ||||||

| Normalized EBIT | 209 | - | -34 | 147 | 322 | 70.4% | ||||||

| Normalized EBITDA | 462 | - | - 55 | 162 | 569 | 35.1% | ||||||

| Normalized EBITDA margin | 25.3% |

|

|

| 29.5% | 409 bps | ||||||

|

|

|

|

|

|

|

| ||||||

| Asia Pacific | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 22 114 | - | - | -1 069 | 21 045 | -4.8% | ||||||

| Revenue | 1 705 | - | -63 | -8 | 1 634 | -0.5% | ||||||

| Cost of sales | - 823 | -7 | 28 | 38 | - 763 | 4.6% | ||||||

| Gross profit | 883 | -7 | -35 | 30 | 871 | 3.4% | ||||||

| SG&A | - 449 | - | 16 | -12 | -445 | -2.7% | ||||||

| Other operating income/(expenses) | 32 | - | -1 | -5 | 26 | -16.9% | ||||||

| Normalized EBIT | 465 | -7 | -19 | 13 | 452 | 2.7% | ||||||

| Normalized EBITDA | 628 | -7 | -25 | 20 | 616 | 3.3% | ||||||

| Normalized EBITDA margin | 36.8% |

|

|

| 37.7% | 138 bps | ||||||

|

|

|

|

|

|

|

| ||||||

| Global Export and Holding Companies | 1Q23 | Scope | Currency | Organic | 1Q24 | Organic | ||||||

| Total volumes (thousand hls) | 66 | - | - | 4 | 70 | 5.7% | ||||||

| Revenue | 117 | - | 1 | -9 | 109 | -7.5% | ||||||

| Cost of sales | -134 | - | 12 | -16 | -138 | -11.7% | ||||||

| Gross profit | -18 | - | 13 | -25 | -29 | - | ||||||

| SG&A | -356 | 1 | 2 | -31 | -385 | -8.8% | ||||||

| Other operating income/(expenses) | -12 | - | -8 | 17 | -3 | - | ||||||

| Normalized EBIT | -386 | 1 | 8 | -39 | -417 | -10.2% | ||||||

| Normalized EBITDA | -288 | 1 | 9 | -16 | -295 | -5.4% |

Investors

Shaun Fullalove

+1 212 573 9287

shaun.fullalove@ab-inbev.com

Ekaterina Baillie

+32 16 276 888

ekaterina.baillie@ab-inbev.com

Cyrus Nentin

+1 646 746 9673

cyrus.nentin@ab-inbev.com

Media

Media Relations

media.relations@ab-inbev.com

ABI Strategic Priorities - English (Graphic: Business Wire)